What To Expect?

Reasons why you should attend our workshops

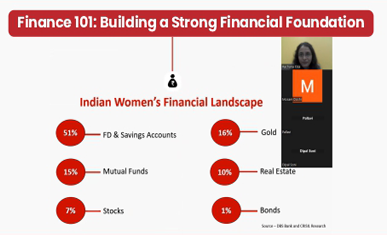

Educational and Woman-Centric

Women-centric workshops will assist them in expanding their financial knowledge and gaining confidence in better managing their finances. Financial Subject Experts explain financial concepts in such a way that any woman may apply them to her daily life and grasp them quickly.

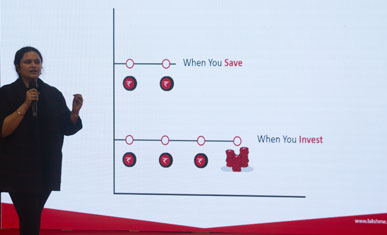

Practical Approach Towards Money

The first step after learning about financial principles is to figure out how to put them into practice. Workshops with a practical approach will serve as a ready reckoner and assist her in taking the first step in financial matters. She will gradually be able to manage her finances on her own.

Encourage and Support Women

Women have all of the skills necessary to be successful investors, but they lack confidence. LakshMe is a platform run by women that encourages other women to ask their financial questions without fear of being judged. This will serve as a link between financial literacy and female empowerment.

.png)

.png)