On International Literacy Day, we held an interactive financial literacy workshop for 30 students of class 12th Commerce at Som Lalit School. Through games and discussions, they learned about budgeting and goal planning. Post-session, students expressed their intent to explore personal finance further and make informed choices about saving and spending for their future. It was heartening to see them gain a strong foundation in financial planning.

08 Sep 2025 | Som Lalit School, Ahmedabad

We recently conducted an engaging session with 120 girls at Charusat University as part of the WDC event. The interactive event combined informative discussions with fun games, including 'What's the Word' and a personal finance-themed chit game. We covered essential topics like money management, budgeting, goal planning, and age-wise financial planning. The girls had a blast while learning, and the gamified approach made the concepts stick. The girls enjoyed it, and we loved seeing them learn through play

26 Aug 2025 | Charusat University, Anand Gujarat

We recently conducted our second webinar with 28 beneficiaries from AdiMahesh Seva Foundation across India on Financial Planning and Asset Allocation. It was a great experience interacting with these young minds, covering key factors in choosing an asset class, introducing different asset classes, and discussing age-wise planning. The participants showed curiosity, asked thoughtful questions, and engaged in learning. We’re grateful for the opportunity to make a positive impact.

23 Aug 2025 | AdiMahesh Seva Foundation

We hosted a dynamic webinar with 35 talented students from across India, all part of the Youthosphere community. It was lively discussions and insightful questions, showcasing their enthusiasm and eagerness to learn. We covered key topics including budgeting, investing, and SMART goal planning. The discussion on financial record keeping really got everyone talking. The students were super engaged and nailed our Q&A session.

21 Jul 2025 | Youthosphere Community

We recently hosted ArthaShiksa, an engaging webinar for 43 women from the National Skill Training Institute for Women in Baroda. Already skilled in Cosmetology and Fashion Design, they now added financial literacy to their toolkit. Covering budgeting, investing, and SMART goal setting, the session empowered them to make informed financial choices. Their enthusiasm and active participation were truly inspiring.

02 Jul 2025 | National Skill Training Institute Baroda, Gujarat

We conducted an engaging webinar with 51 beneficiaries from AdiMahesh Seva Foundation across India, covering personal finance basics, the Kakeibo method, and SMART goals. A fun "Never Have I Ever" game encouraged interactive learning. With outstanding participation, the session was both informative and enjoyable, empowering students to manage their finances effectively.

28 Jun 2025 | AdiMahesh Seva Foundation

We recently hosted an engaging webinar on Risk Management and Women's Guide to Insurance, where we covered crucial topics such as: Risk Management and understanding risk levels, Essential healthcare checklist for women, Financial planning basics using a pyramid structure, and the Importance of Life & Health Insurance in securing financial futures. Our interactive session brought together around 20 women from across India, providing a valuable platform for knowledge sharing and empowerment.

24 May 2025 | LakshMe Community

Our recent workshop at Sahaay Sorainagar Centre was a hit! 51 curious kids from 1st to 7th grade joined in. We tailored sessions for each age group 1st to 4th graders learned banking basics like needs vs wants and KYC, while 5th to 7th graders explored digital payments, card types, and the RBI. Our Musical Money Game and Finance Bingo made learning fun, with incredible participation from the kids.

26 Apr 2025 | Sahaay Sorainagar Centre, Ahmedabad, Gujarat

Recently, we conducted a workshop on money, savings and banking for 223 students at Hansol Primary School. With interactive games, videos, and discussions, we covered topics such as the functions of the RBI, the time value of money, Budgeting, and the impact of inflation on savings. This workshop helped lay a strong foundation in financial literacy, providing a solid base of basic financial knowledge.

03 Apr 2025 | Hansol Primary School, Hansol, Ahmedabad, Gujarat

.png)

We had an engaging session with 65 bright B.Tech students from Nirma University, Ahmedabad!

Through interactive discussions, an informative video, and relatable practical examples, we explored:

• Financial planning for every life stage

• Creating SMART goals for a secure future

• Thumb rules for personal finance

• Asset allocation strategies

We wrapped up with a rapid-fire Q&A quiz, where students enthusiastically answered our questions!

01 Apr 2025 | Nirma University, Students of B.Tech, Ahmedabad, Gujarat

Our Global Money Week sessions continue! Team LakshMe had the pleasure to meet & interact with over 80 kids from Amiyapur Primary School. Through fun activities and interactive discussions, we introduced them to the world of finance. It was inspiring to see their curiosity and enthusiasm as they learned the importance of ‘Learn. Save. Earn.’ A truly enriching experience for us and the kids!

22 Mar 2025 | Amiyapur Primary School, Gujarat

Team LakshMe recently conducted interactive financial literacy workshops at Prudent Pathshala, Jantanagar Primary School, and Navagam Primary School, engaging with 240 enthusiastic students! Our workshops revolved around the Global Money Week slogan: "Learn. Save. Earn." We explored key concepts like needs vs wants, banking, RBI functions, savings, income, expenses, and investing for a secure future. Seeing the students' eagerness to learn was truly heartening! Here's a glimpse.

20 Mar 2025 | Prudent Pathshala, Jantanagar Primary School and Navagam Primary School

Team LakshMe was delighted to meet and interact with the bright young kids at the Gopalnagar Primary School as part of Global Money Week 2025. We held an engaging and interactive workshop with 47 children - and taught them the value of ‘Learn. Save. Earn.’ We explored the basics of finance, like the difference between needs & wants, savings, income, and expenses, and more complex topics like banking and the functioning of the RBI. It was a very enriching experience for our team and the school's enthusiastic kids.

18 Mar 2025 | Gopalnagar Primary School, Kalol

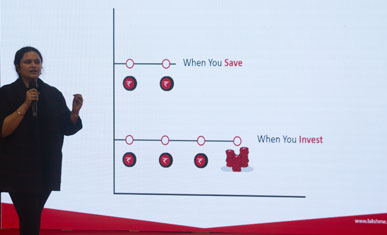

Aligned with GMW 2025's theme, Learn. Save. Earn., Team LakshMe conducted an interactive workshop with 20 students from the Samarth Centre, supported by Prudent. These young minds from underserved communities explored key financial concepts—needs vs wants, banking, RBI functions, savings, income, expenses, and the power of investing beyond saving. Their enthusiasm and engagement were truly heartening!

17 Mar 2025 | Samarth Education Centre, Ahmedabad

As a part of our mission, we launched Project Margdarshan to educate students about the basics of financial literacy. Our interactive program focuses on essential life skills such as Budgeting, the Importance of savings, understanding the functions of banks, and distinguishing between needs and wants. Over the past few days, we've had the privilege of conducting engaging activities with 300+ students of 6th to 8th standard from 4 government schools.

20 Feb 2025 | Government Schools, Gandhinagar

We recently held an engaging workshop at the Saksham Centre for Livelihood with 72 enthusiastic women, featuring interactive games, teamwork, and valuable lessons. The session highlighted women’s unique strengths as investors, the importance of regular savings, the impact of inflation, and the need for wise investments, all delivered through fun activities to enhance learning.

22 Jan 2025 | Saksham Center, Ahmedabad

We invited financial educator Ms Salloni Mehta from Black Pebble Education to conduct an interactive workshop for the students of our Samarth Education Centre. She expertly engaged students who are from 6th to 12th standard in an interactive two-hour workshop, utilizing role-playing and other activities to convey essential financial concepts. The students had a fantastic time while gaining valuable insights into the time value of money, budgeting, and the crucial distinction between needs and wants.

28 Dec 2024 | Samarth Education Centre, Ahmedabad

Team LakshMe at BDK Arts and Commerce Government College, Gadhada, where we interacted with an enthusiastic audience of 115 young women from nearby villages. The students, pursuing commerce and arts streams, actively participated in our session on basic money management, goal planning, and personal finance. The response was overwhelmingly positive, with participants expressing gratitude for the useful insights and committing to work towards achieving their financial objectives.

24 Dec 2024 | Bhaktraj Dada Khachar Arts and Commerce Govt. College, Gadhada

We recently conducted an engaging financial education session for B.Com (Hons) Semester V students at Nirma University. The interactive and gamified session covered essential topics such as Cash Flow of Life, SMART Goal Planning, Life Cycle Goals, Asset Allocation (Equity, Debt, Hybrid, Others), Thumb Rules, and Red Flags for Financial Planning. Our mission to empower the next generation with financial literacy took a significant step forward.

14 Nov 2024 | Nirma University, Students of B.com (Hons), Ahmedabad

We conducted a 4-day workshop for IMBA Semester 1 students at JG University Ahmedabad. We covered: Personal finance myths, budgeting hacks, setting SMART goals, strategic financial moves, interesting facts on money, and the concept of the time value of money. Through gamified and interactive sessions, over 300+ students benefited from our expert guidance, engaging financial concepts in a fun way! The students' enthusiasm was contagious!

28 Sep 2024 | JG University, Students of IMBA, Ahmedabad

We recently conducted a workshop for over 100 EC students of Polytechnic where we discussed essential money management skills. We covered the basics of handling money, the difference between being rich and wealthy, and how to set financial goals. The participants' enthusiasm for learning something new was evident, creating an engaging and dynamic environment. By incorporating relevant facts we ensured everyone left with a solid understanding of basic financial concepts.

01 Aug 2024 | Polytechnic EC Department, Ahmedabad

Our CSR team hosted a fun-filled 3-day summer camp for underprivileged kids. Beyond arts, dress-up, and tree planting, one day focused on financial literacy. Through interactive games, they learned valuable life skills: saving, differentiating needs from wants, the role of banks, understanding KYC, and even the importance of taxes – all while having a blast! This camp equipped them with a foundation for future financial success.

04 Jun 2024 | Students of Mangal Navkar Mahek Group, Ahmedabad

We recently hosted a workshop for MBA interns from different universities on "Your Roadmap to Financial Security". This interactive session focused on equipping future business leaders with the knowledge and tools to confidently navigate their financial lives. The workshop covered three key areas: Budgeting Basics, Goal Setting and Building Your Safety Net.

29 May 2024 | MBA Interns, Ahmedabad

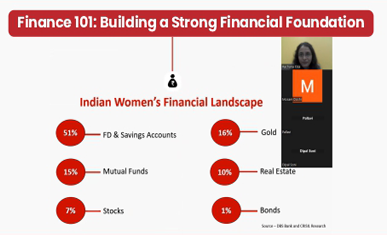

The webinar covered crucial topics like personal finance, budgeting, and various investment avenues such as mutual funds, fixed deposits, SIPs, and more. The event featured lively discussions and informative Q&A rounds. This interactive session empowered Women with the tools and confidence to navigate their financial future.

11 Mar 2024 | Women Employees of Prudent, Ahmedabad

This workshop emphasized the crucial role of record keeping and nomination, stressing that every woman should be well-informed about family investments. Women need to understand the financial status of their families. The session covered nomination, the MWP Act, Will, and related topics, empowering women with essential knowledge for financial planning and security.

05 Mar 2024 | Ahmedabad

In collaboration with AIESEC, LakshMe hosted an interactive guest session merging finance education with fun. Tailored for diverse academic backgrounds, topics covered included saving versus investing, Kakeibo budgeting, goal planning, and investment basics. This empowered students with the confidence to navigate their financial futures effectively.

21 Mar 2024 | AIESEC, Ahmedabad

LakshMe celebrated its 3rd anniversary with a groundbreaking offline workshop exclusively for women. Over 150 participants enjoyed diverse sessions, including an ice-breaking "Never Have I Ever" game. The workshop covered crucial topics like personal finance, budgeting, and various investment avenues such as mutual funds, fixed deposits, SIPs, and more. The event featured lively discussions, informative Q&A rounds, and interactive games, concluding with snacks and a joyous atmosphere of camaraderie.

09 Mar 2024 | DoubleTree By Hilton, Ahmedabad

In collaboration with Ahmedabad University's Women Empowerment Forum, LakshMe led a captivating guest session, infusing personal finance knowledge with fun. Tailored for diverse academic backgrounds, the session covered saving vs. investing, Kakeibo budgeting, goal planning, and investment basics inspired by legends. This interactive session empowered students with the tools and confidence to navigate their financial futures.

28 Feb 2024 | Ahmedabad University, Ahmedabad

An insightful session with the students of Marwadi University. It’s inspiring to see growing awareness of financial knowledge among students. We discussed investing lessons from Warren Buffett, budgeting hacks, why one should start an investment journey from an earlier age, the impact of inflation on investments, and the financial planning life cycle.

19 Dec 2023 | Marwadi University, Rajkot

We recently held an insightful session dedicated to enhancing financial well-being. Our discussion delved into interesting budgeting methods that the Japanese used to follow called Kakeibo, personal finance myths, defining the true essence of wealth, and exploring key financial planning concepts. It's incredibly encouraging to witness the growing awareness and interest in financial literacy among the next generation.

01 Nov 2023 | Karnavati University , Gandhinagar

During our recent Financial Literacy Workshop, we enlightened almost 300 incredible women on the importance of financial literacy and managing personal finances. We showcased women's innate abilities in budgeting, saving, and investing through real-life illustrations. We explored the crucial idea of financial planning and its transformative impact.

27 Oct 2023 | Mangal Navkar Mahek Group, Ahmedabad

Team LakshMe had the privilege of engaging with the bright minds of Polytechnic College. We explored the benefits of investing, budgeting skills, goal setting, financial planning, and government entrepreneurship schemes. Their enthusiasm and curiosity are the driving force behind our commitment to fostering financial empowerment.

07 Oct 2023 | Government Polytechnic College, Ahmedabad

A Workshop at Sughad Primary School on Financial Literacy for Primary Students. The key points covered were Banking, functions of bank, RBI, different payment modes, good loan and bad loans, income-expense & savings, etc. And ending the session with a Fun quiz round, It was an enriching and interactive session.

08 Sep 2023 | Sughad Primary School, Gandhinagar

A Workshop at Amiyapur Primary School on Financial Literacy for approximately 75 Primary Students. The key points covered were Banking, the Role of RBI, Banking services like RTGS, IMPS, NEFT, UPI, Cheques, Debit cards, credit cards, and loans. And ending the session with a Fun quiz round, it was an enriching and interactive session.

01 Aug 2023 | Amiyapur Primary School, Ahmedabad

Maitry Shah had an interactive session with more than 50 young customer care members of Prudent. It was an informative session on gaining financial self-reliance. The topics covered were the significance of investments, needs vs wants, identifying bad money habits, and thumb rules of personal finance.

02 Jul 2023 | Prudent Group, Silver Cloud, Ahmedabad

The facts showing the financial literacy status in India, Why women find it difficult to talk about money matters and the importance of financial literacy for women and society.

The session was followed by a very interactive Q&A.

29 Apr 2023 | PLC Convention-23. Jio World Convention Center, Mumbai.

A Guest Session with CAIT YE Talk on Making her Financially Atmanirbhar. The key points covered were Insurance planning, Tax planning, Retirement planning, the importance of investing, Goal planning, and SIP. A very diverse group of the audience was present in this workshop, consisting of homemakers, professionals, salaried employees, entrepreneurs, and individuals who hold important decision-making roles in various aspects of their lives. It was an interactive and enriching session followed by an interesting Q&A round.

27 May 2023 | CAIT YE Talk , Ahmedabad

A Guest Session at GLS University on Personal Finance Well-being and Economy. The key points covered were budgeting, the importance of investing, goal Planning, and a few Micro and Macroeconomics concepts. How these economic concepts affect our personal finance.

07 Nov 2022 | GLS University, Ahmedabad

Day 1 Awareness of very basic financial concepts like What is Income, Expenses, Debt, etc. How to Identify Needs and Wants. How Budgeting helps in financial planning.

Day 2 Importance of financial goals and goal planning. An investor must make a decision based on his or her financial objectives and risk tolerance. A fundamental understanding of investment products, including their characteristics, pros, and cons.

23 Jun 2022 | Samvedana - Project Eklavya, Ahmedabad

There is an extensive number of investment products. An investor must make a decision based on his or her financial objectives and risk tolerance. A fundamental understanding of investment products, including their characteristics, pros and cons, taxation, etc.

12 May 2022 | Synapse - DA-IICT, Gandhinagar

Explained the fundamentals of personal finance, such as the need for financial planning at an early age, the power of compounding, goal planning, and the significance of SIPs in mutual funds.

18 Apr 2022 | Innovator club - LD College of Engineering , Ahmedabad

Women's current investment patterns, why don't women discuss money matters?, Importance of investing money for her, Women's characteristics that make them better investors, as well as how to get started or take the initial step.

23 Oct 2021 | Research Foundation of India & JHERF

The facts showing the financial literacy status in India, Why women find it difficult to talk about money matters and the importance of financial literacy for women and society.

The session was followed by a very interactive Q&A.

08 Sep 2021 | Research Foundation of India & JHERF

Signin

Dont have an account? SIGN UP

Forgot Password?

Sign up to unlock these benefits:

Already have an account? SIGN IN

We have sent a verification link on your email ID

FORGOT PASSWORD

Confirm Password

Enter your email id to download the PDF.

Quarterly Magazine

Comment Update

My Family Record Book has been specifically designed keeping in mind important financial, medical, personal, and other miscellaneous information that is important for the family to know.